Gold Price Sees Wild Swings, and Interest Grows in Uranium

Author: Marco Santanche

All that glitters is not gold

We are experiencing a series of wild swings in gold, which went up to $2,133 on December 4, before sharply falling back to the $2,000 region. Some of the factors that pushed the precious metal so high are likely a combination of rate-cut bets and safe-haven demand with the weaker dollar, but this does not feel sufficient to explain the very quick spike. A geopolitical explanation also seems insufficient, since there was no particular event leading to such a move.

The most likely explanation is the massive moves of funds due to hitting a key price level, which might have self-fueled quickly to lead prices to unexpectedly high levels. In any case, the outlook for the yellow metal appears to still be positive: the concrete possibility of falling rates and a weaker dollar will surely increase demand for safe-haven assets.

Moreover, central banks usually hold gold reserves to protect their assets and diversify their portfolios and, according to the World Gold Council, in Q3 ETFs have (net) purchased almost 30 tonnes of gold, especially in Europe. Central banks have also strongly added to their reserves, with net purchases of 337 tonnes. These figures are likely to be replicated at least in Q4, with the increased orientation of banks towards lower rates regimes. Investment demand is mixed, but COMEX net long positioning still shows a growing long net position in futures over the past few months.

The general take is that most of the demand and supply factors, plus the investment and policy side, are pushing for higher prices in the upcoming months. Geopolitical tensions might improve these figures and bring further tailwind to the metal. But this comes not without risk: the policy rate decisions might still be delayed or uncertain, and today's non-farm payrolls are already weighing on gold prices.

If the dollar strengthens further and keeps its dominance, unimpacted by Fed cuts against other currencies, the metal might struggle to prolong its positive trend.

The case for uranium

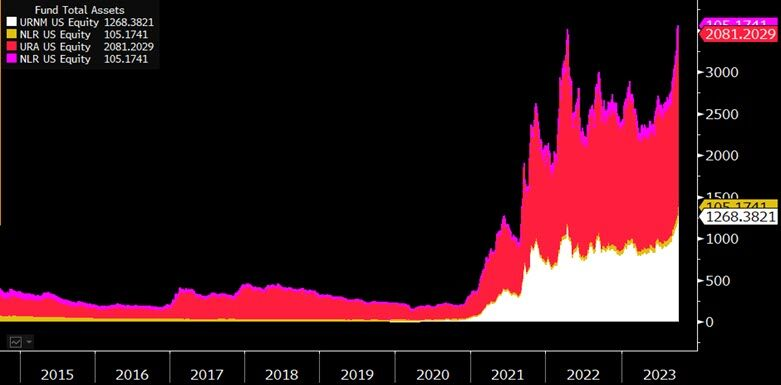

A rising stock market that is capturing the interest of major hedge funds is one linked to renewable energy sources: uranium. This sector has grown incredibly in assets under management, and has brought additional fuel to the renewable energy sector as a whole.

Growth in AuM for uranium ETFs:

The International Energy Agency has urged an increase in efforts in order to reach net zero emissions by 2050, in line with national and international targets. While controversial, especially due to the Fukushima nuclear accident in 2011, the energy resource remains an important factor in moving towards net zero carbon emissions.

The appeal for this commodity has grown further since Russia's invasion of Ukraine, which led Europe to move away from natural gas. However, Russia still sits on 8% of the world's recoverable conventional uranium resources. Wind and solar power are probably less dangerous and equally or more sustainable, however the problem of storage and transportation towards regions that are less exposed to their origination is challenging.

Regardless of the possible innovations with regards to conservation and production of clean energy from renewable sources, the market seems to be interested in this opportunity.

A number of stocks and ETFs have seen increasing volumes over recent times, one of the most popular being the Global X Uranium ETF (URA), up 34% this year. Its volumes have increased dramatically since 2020 and it distributes semi-annual dividends. Similarly, the VanEck Uranium and Nuclear Technologies ETF (NUCL) has shown a strong performance (up 21.48% since February) and a much lower TER.

With the hope of improving the world's energy sustainability, uranium stocks and ETFs could be a good and forward-looking opportunity.

Opinion: Gemini, the GPT challenger

Large language models are not the future anymore: they are the present.

The next one that is going to be launched soon is Gemini by Google, and the aim is that it will empower the global colossus with its services in all its current products, including Google search, cloud, even mobile applications (thanks to a lighter version, Gemini Nano, on Google Pixel 8 Pro), and more. With the ability to work with text, images, videos and audio files, this new tool might bring the war for the next AI system to the next level in investments too.

Their target is to make it perform better than humans in many tasks, and the natural question for us is: will it improve trading? Many of my clients and partners have come across this question, pushed by the hype of new technological advancements to find the next generation of investment strategies. The idea is good and it will have a positive answer at some point, but there are some ifs and buts.

First of all, let's break the news down: while Gemini might be a huge resource for many companies, we still need to see if it is a big improvement from GPT. According to Google, Gemini will be able to improve Python coding, for the LLM benchmarks. But being able to code is different from producing trading strategies. First of all, we have no idea, as it stands, about the 'hallucination' problem of LLMs. It remains a hard-to-tackle issue for these AIs, since they might elaborate information in a wrong way, or sometimes invent it. And this is definitely something we do not want to happen with our investments. In finance, we know the outcome of some findings only after a large lag, leading to investment risk in the case of portfolio management and trading strategies.

Moreover, their capabilities are limited to text: there are plenty of papers in the market, however not all of them find results that are practically meaningful, since they need to make assumptions. No matter the backtest technique, investment idea/thesis or mathematical soundness, these AI models can still only rely on what is written on the paper. They cannot derive formulas, they cannot check for assumptions validity and realistic expectations, they cannot do anything but trust the source as a valid input. And this is also related to fake news production and hallucinations.

Finally, the vast majority of traders think that their relative strength index strategy can be improved by AI. This is never the case. AI will (maybe) find patterns (though machine learning is much better for this application, and I am unsure of LLM's potential in this regard), but if the signal is wrong or bad, there is no underlying value and no tool will produce value out of nothing. AI, and ML as well, derive their power from the data they are fed with. And if the data is poor - such as lagging, unpredictive features - AI will not improve it. A trading strategy might still coincidentally work (with or without AI) if there is no causal relationship between the two variables - until it doesn't.

An important criticism when it comes to Google must also be on a business level: how come one of the major technology companies in the world has struggled all this time (ChatGPT was released a year ago) to produce something that is just comparably good, maybe slightly better, than something already existing, instead of working on unprecedented technologies and products?

This content is for educational purposes only and is NOT financial advice. Before acting on any information you must consult with your financial advisor.