Currency ETFs: A Complete Guide

Author: Marco Santanche

An often overlooked, yet important factor for investment performance is the currency exchange rate of our assets. Whenever we decide to invest in an ETF (or any type of financial instrument), we need to pay attention to its underlying currency. This is especially the case for buy-and-hold strategies, where exchange rate fluctuations can either impair or enhance performance. Many issuers offer ETFs which are designed to hedge this risk factor. These funds aim to expose investors to potential gains from foreign currency appreciation, thereby offering a strategy to mitigate losses that may arise solely from the depreciation of the currency relative to our home currency.

Why Invest in Currency ETFs

Investing in currency ETFs in the hope of large returns is normally not a winning strategy. Currencies are notoriously volatile, influenced by a complex interplay of factors like monetary policy, trade flows, and commodity prices. This high volatility makes consistent value appreciation difficult.

The true benefit of incorporating a currency ETF into our portfolio is to avoid losses, in case a large portion of our portfolio is exposed to foreign currency risks. By strategically hedging our portfolio, we can protect ourselves from potential fluctuations in foreign currencies. This benefit extends to cash flows as well, since dividends are typically paid in the local currency of the issuing company or fund.

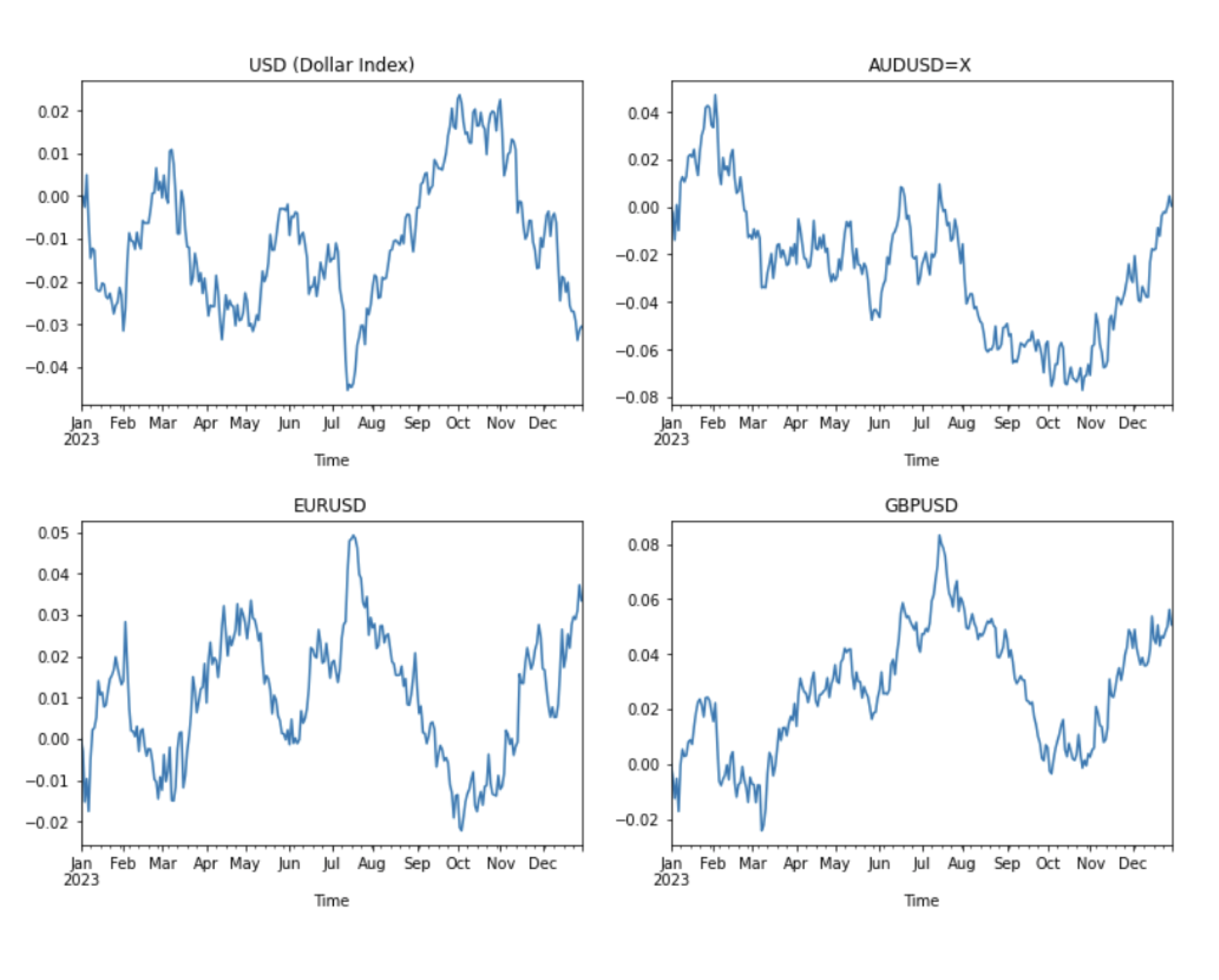

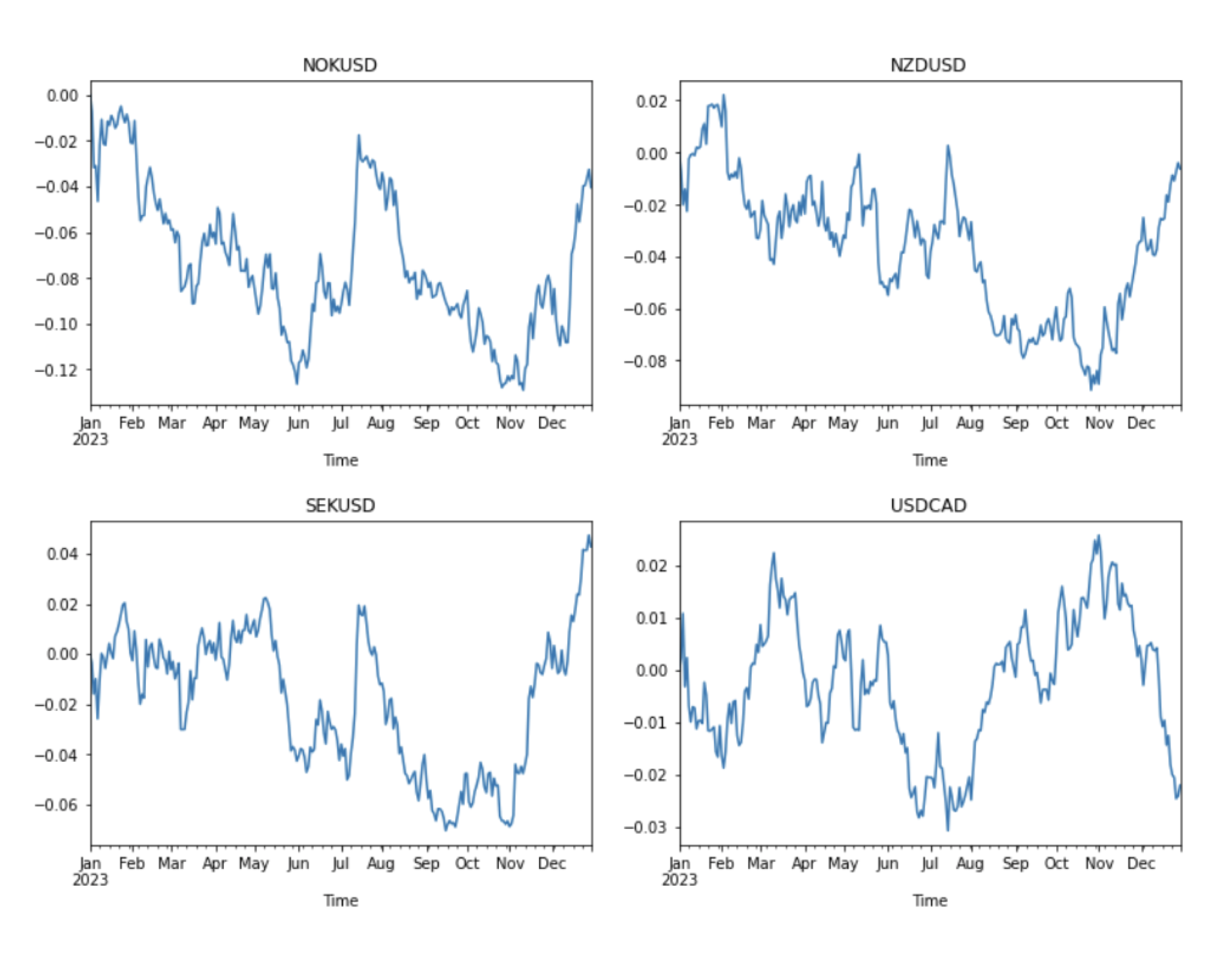

When examining the performance of the G10 currencies - which include the world's most liquid currencies (USD, CAD, EUR, GBP, CHF, JPY, AUD, NZD, NOK, SEK) - their behavior has been quite volatile. However, this volatility has not consistently resulted in significant gains or losses across all these currencies, as we can see from the normalized charts below.

There are clearly some correlations and important trends among these currencies, since all currencies trade against the USD. The dollar index, which tracks the performance of the USD against a basket of currencies (including some of those mentioned), often mirrors the path for many of these currencies (though sometimes in a reversed manner).

It's important to understand that investing in a currency ETF involves considerations distinct from those associated with an equity ETF. However, consider a scenario where we're contemplating an investment in the Nikkei 225. In such a case, hedging against the USDJPY exchange rate becomes highly relevant. Failing to account for the currency risk, particularly when the Nikkei is denominated in JPY, could significantly erode our returns due to the volatility in the foreign exchange market.

Is Hedging with Currency ETFs the Answer?

Although foreign exchange issues often pose challenges for investors outside the US, it can sometimes enhance performance. For example, if we were Japanese investors considering an investment in the S&P 500, we might have benefited from the USDJPY exchange rate. As the year progressed, our USD-denominated investment (S&P 500) would have increased in value when converted back to JPY, providing a favorable return boost.

For more sophisticated and experienced investors, the options market offers sophisticated tools to manage currency risk and secure gains. Take the USDJPY example again. Imagine securing your profits by purchasing a USDJPY put option. If the USD weakens against the JPY, you could exercise the option and convert your dollars at the pre-established rate, protecting your initial gains. While you'd pay a premium for this insurance, it wouldn't cap potential upside from further exchange rate movement.

However, wielding such tools requires caution. FX options often carry high premiums and complexities, making them less accessible and demanding to manage compared to standard ETFs. They're best suited for sophisticated investors with experience navigating the over-the-counter derivatives market.

But hedging FX risk is the answer to ensure we do not want a surprise when redeeming our investment. And we can easily implement it with currency ETFs.

Hedging A Portfolio

We now do a little experiment for our investors outside the US. What would have happened if we really liked the Nasdaq Composite last year, but we wanted to hedge against the USD appreciation against our currency?

We would just need to purchase enough shares of an ETF to ensure we can hedge the right amount of capital. For instance, if we purchased a total of $1M in SPY, we might want to hedge for a total of $1M in our foreign currency, such that if the USD moves down against it, we would make profits on the currency fund.

Below is a list of ETFs we will consider:

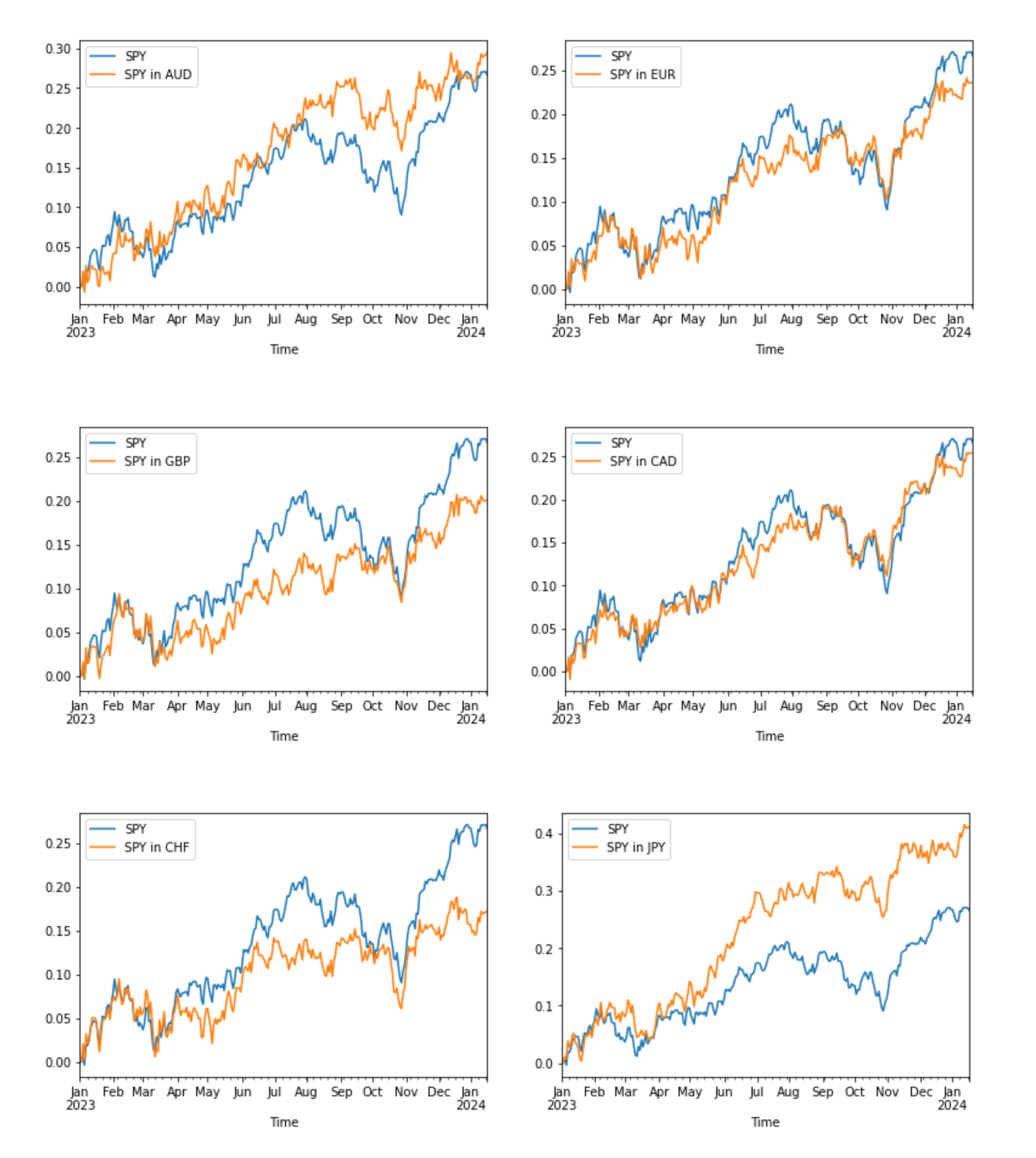

Now, what happens to an investor that is 100% invested in the SPY ETF, but has a different home currency? We will consider only the above currencies, for whom we have a currency fund.

As we can see, the FX can dramatically impact the performance of our investment, either positively or negatively. A Swiss investor would have been heavily damaged by the CHF appreciation against the dollar, while a Japanese investor would have outperformed, given the strong run of JPY.

But this is the past, and we don’t know if similar patterns will happen with the other currencies. Can we hedge that?

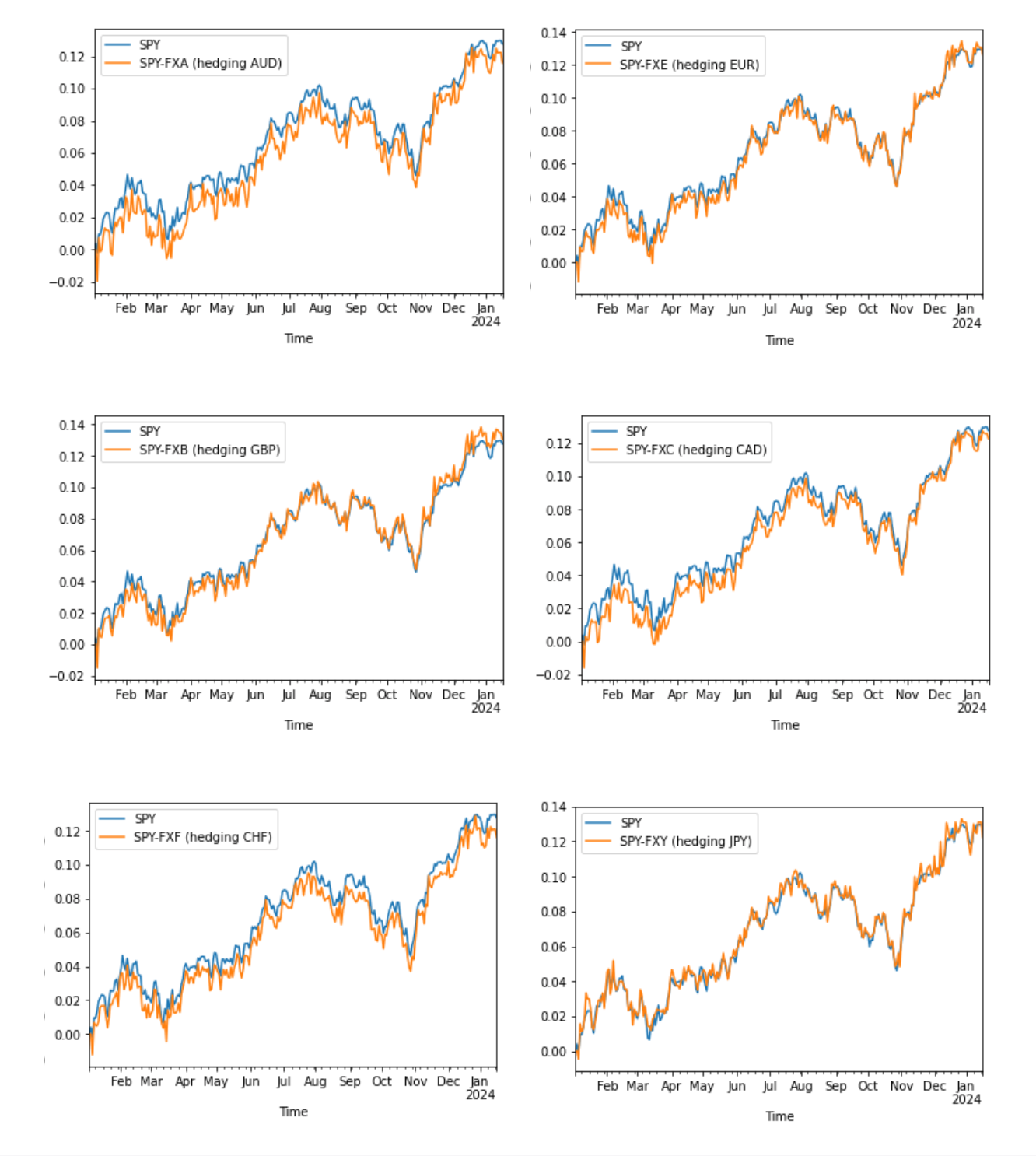

Certainly. Any fund we invest in must account for FX profits and losses, in order to accurately reflect the performance of our portfolio in our desired currency. Using currency ETFs for hedging helps neutralize this risk factor, allowing us to profit solely from the underlying investment’s performance..

This strategy is similar to what ETFs like the iShares S&P 500 EUR Hedged UCITS ETF (IUSE) employ to deliver returns to investors. Often, it might be simpler and more cost-effective to invest in such hedged ETFs when available. However, in cases where a hedged version of an ETF is not available, or when one's investment spans multiple funds in different currencies, utilizing currency ETFs can be an effective alternative.

A clear pitfall in the approach is however that we would need exactly the same portion of capital invested in the currency and the index. This might be suboptimal, but necessary in order to avoid the exchange rate fluctuations. A good alternative to this is to use FX Options.

FX Forward and Options

FX options and forwards, as OTC derivatives, are not traded on listed exchanges. Normally, access to such derivatives is limited to institutional or professional investors.

These instruments' fees and collateral vary, and their performance is influenced by interest rates due to the implicit borrowing cost in the forward price. FX forwards can mitigate FX risk symmetrically, balancing SPY's profits and losses due to exchange rate fluctuations.

With FX forwards, we commit to an exchange rate for a future date. This can result in similar profits and losses as with currency ETFs, but profits hinge on the locked-in rate. The fee and collateral for these instruments can vary, and the performance is also related to interest rates, due to the implicit borrowing cost in the forward price.

For FX options, we would instead lock in the rate for a much smaller fee (the option premium), which allows us to never lose money if the rate moves against us (other than the premium we paid), but we can make a profit if the rate is moving in our favour.

The mechanism seems complicated at first, but it actually results in a more efficient way to allocate capital. If, for example, we invest $1 million in SPY (an S&P 500 ETF) and our home currency ABC is trading at 0.95 cents of a USD (exchange rate ABCUSD = 0.95). We might want to lock in the current exchange rate with a call, which allows us to benefit from upsides in the exchange rate.

This means that we will incur losses on our SPY investment if the exchange rate appreciates, because the same amount of USD will be able to purchase less ABC. But the advantage with an option is that if the rate moves lower, we will profit from exchange rate movement, while currency funds, hedged ETFs and FX forwards would lose money, balancing the profits on the dollar investment.

To illustrate this, let’s say ABCUSD goes from 0.95 to 0.8. In this case, our portfolio actually profits from it: our $1M SPY investment (regardless of the movement of SPY) would record a profit just because that $1M is now worth ABC 1.25M (up from ABC 1.05M when ABCUSD=0.95). This means that when we divest, we get a larger amount of ABC.

Note that an option would not lose more money than the premium we originally paid, leading to keeping all the profits in this sense. Thus, the SPY investment is now worth more ABC than initially, and the option does not lose any money.

Another benefit is capital efficiency: with currency ETFs, we would need to purchase exactly the same dollar amount of the ETF to hedge the foreign currency. That is, with $1M in SPY, we need $1M an ABC ETF, which allows us to profit from exchange rate movements.

But with options, we just need a notional value of ABC 950,000, with a strike price of 0.95. That is, we have the right to give ABC 950,000 to our broker, and they are obliged to give us $1M due to the option contract, which could be worth more or less in ABC terms because of the exchange rate movements.

This approach is usually more capital efficient, requiring collateral maintenance and premium payment rather than investing the full amount in another fund. However, its effectiveness depends on market conditions and fees.

Conclusion

Currency ETFs and FX instruments can help us hedge away the risk of appreciation of one currency against another one, and maintain our profits in the investment without worrying about the moves in prices. On the other hand, it requires capital investments and monitoring, especially for more sophisticated hedges, which needs careful consideration on fees, efficiency and execution.

Update on Strategies

A very difficult time in the markets, as VIX profits and DBMF manages to capture some of the upside, with short term bonds providing some protection. For the rest, a general correction which results in hard times for many investors, but it does not seem like a long term trend.

Updates as of 17/01/24: