Volatility ETFs: A Complete Guide

Author: Marco Santanche

Volatility has always been a fascinating strategy. It seems very attractive when traded with options: profitable in both positive and negative scenarios, as long as the size of the move is big enough.

With ETFs, and generally speaking when trading simpler instruments, volatility is much more complicated to capture. There is no symmetrical trade that we can directly buy and hold; we need to identify entries and exits to go long and short, which could tempt us to time the market.

The fact is, trading volatility is very hard if one does not have access to the derivatives markets. Some try with technical analysis: one of the most famous technical indicators used to trade when an asset breaks over the volatility range is the Bollinger Bands. But, like many technical analysis indicators and theories, it just tells us what happened, but not if it will last, nor if it is a good time to enter into a position.

An additional concern is that volatility is not really symmetrical, although the trade implementation with options might be: we normally experience higher levels during bear markets, and lower ones when there is a bullish trend. Moreover, due to the calculation methodology (volatility is the standard deviation of the returns of an asset), it can be observed in clusters, due to its slow changes. That does not mean that predicting volatility is easy (or that it guarantees any positive performance with volatility strategies), but it just tells us something more about the past, because it looks back to some period in order to be calculated.

The VIX

There are other ways of measuring volatility. One goes back about 50 years to Black, Merton, Scholes and their famous formula, which helped investors understand how to calculate option prices, including the standard deviation of the underlying as an input. Then, provided that we can directly observe prices, the notion of “implied volatility” told us that assuming it constant, as per the original model, is not a realistic reflection of what happens on the markets.

And since implied volatility was becoming increasingly more important, especially as it was deviating from the realized moves of returns across their mean, the focus shifted to reverse-engineering the prices of options to get the risk of the major asset available on the markets, the S&P 500. This resulted in the so-called “Fear Index”, and, as Albert Einstein said: Three great forces rule the world: stupidity, fear and greed.

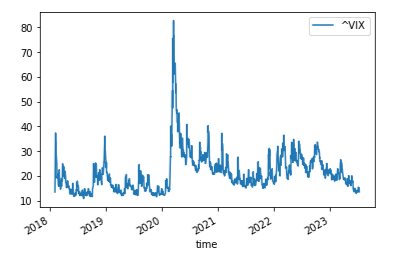

Enter the VIX. Implied volatility (IV) grows when option prices grow, since options benefit from moves in their underlying’s price. But as mentioned, this is often asymmetric, and we can observe higher IV (higher VIX levels) whenever there is a global crisis, including the 2007-08 financial crisis and the Covid-19 pandemic. Please find below the chart from 2018.

It seems appealing to invest in a similar asset from time to time, in order to hedge downside risk. However, over time, there would be no growth in the invested capital. But most importantly, the VIX cannot be traded, because it comes from a calculation and not from market prices.

What options do we have to obtain similar returns to those in the chart? There are derivatives. However, not everyone has access to them, and investing in the VIX directly is probably not a good idea.

Why timing volatility is deceptively hard

Having a small portion of our portfolio in a VIX-like instrument seems to be a good hedge for when markets are navigating tough times. However, guessing the entry and exit points is considered impossible by many, and at least challenging by every professional.

Investing in the VIX at the very beginning of its spikes seems trivial in hindsight. But as one can see from the chart, it is the immediate, steep retracements that make it impossible to time it. And using it as a forward-looking indicator does not help either, because the prices of options usually increase when panic has spread already. Of course, if it were this easy, everyone would do it, and the opportunity would quickly fade away.

ETF strategies

Some ETF issuers have produced strategies to try to benefit from the favorable properties of VIX, without necessarily exposing investors to the sharp falls that follow. In particular, the features that characterize such strategies are:

- Leverage: there are plenty of leveraged VIX strategies, with the target of providing investors with magnified returns whenever the spikes occur, but resetting leverage every day to profit only over the short term. Most of the VIX holders are indeed short term (for the evident lack of long-term value in the way it is calculated: it just gives us an idea of the prices of options right now), and as such, multiplying these short-term moves can improve the profitability of the investment.

- Different investment horizon: long-term and short-term futures might move differently, depending on the market expectations of the duration of the volatility regime we are in. This means that profiting from calendar differences is also possible, and probably appealing, since it is not a matter of growth of the markets, but rather price conditions that might revert soon.

- Short volatility: the idea comes directly from what we discussed. It is true that getting the time for the spike is difficult, however, the real challenge is timing the exit. If we look at it from another perspective, it might then be easier to know when to short volatility, because we can anticipate it more or less confidently, and we would then have more time to wait for things to normalize.

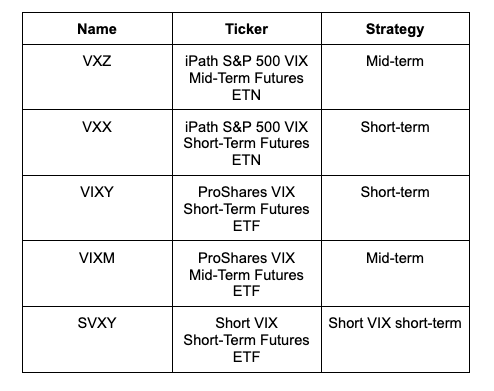

The ETFs (and ETNs) we will now consider are relying on the last two types of strategy, and are explained in the table below. Please note that I did not include the Short VIX Mid-Term Futures ETF (ZIVB) due to data availability (it only starts in 2023).

None of the strategies is intended for buy and hold. All of them include significant risks and pitfalls that will eventually be more harmful than beneficial to your portfolio. However, the ideas are interesting, and we might want to look at them from a close perspective.

Correlations

Many investors believe that VIX ETFs/futures can help you diversify your portfolio in periods of market stress, or see it as a complete hedge to equity risk. As explained, the VIX is instead an index that calculates implied volatility, which during bear markets tends to go higher, but it is hard to time.

A strategy aiming at using VIX ETFs as a buy-and-hold investment is set to fail. Even if it might be better than holding cash, it is difficult to manage a portfolio with VIX ETFs during bear markets. Timing with accuracy those events where the index falls is the main concern that contributes negatively to performance. Moreover, the hedging effect might not be perfect, as there might be high prices for options even if the market is still good and healthy, which in turn triggers a sort of false negative signal.

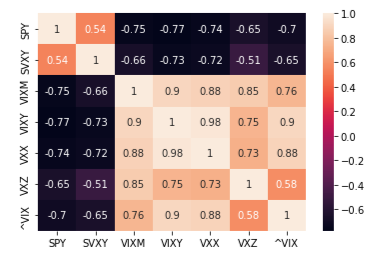

But these ETFs can offer some benefits. Let us first of all have a look at how they correlate with each other:

As expected, many of these ETFs have a strong negative correlation with the S&P 500. SVXY is instead a short VIX fund, thus it still keeps a positive correlation. But a surprise is that VXZ (iPath S&P 500 VIX Mid-Term Futures ETN) still has a low (in absolute terms) correlation with the VIX compared with other funds.

Yearly performance

We are now going to see how the strategies behave at different times. Here is a chart for each year, starting in February 2018 due to data availability (data is rebased to 1 at the beginning of the year, then returns are compounded):

There are times, especially during Covid in 2020 and the war in 2023, where the spike is particularly evident, and the Short VIX ETFs exhibit the opposite move when compared with the others, although with much lower volatility. However, this is not always the case: during 2022, we saw sharp moves in the long volatility indices, but the short ones did not move as much. This is to further stress that IV is not necessarily the opposite of bull markets.

From a strategy description standpoint, these indices do not replicate the VIX by buying futures, but rather work on replicating the short-term or mid-term implied volatility in the S&P 500 options market according to different criteria. They can still hold a number of securities in order to fulfil their mandate, which include, but are not limited to, S&P 500 options.

Baseline strategy: timing the S&P 500

Needless to say, the difficulty of timing the VIX is only the consequence of the S&P 500 being different to time (after all, that is a logical consequence of investing: if it is easy to time, it is easily available, and the opportunity must fade away at some point).

For the moment, let us suppose we can time the S&P 500. Whenever the price falls under its 200-day moving average, we go into cash, and come back to the investment only when the index price is over that level. We are going to use SPY for this exercise.

The results show a performance no better than the buy-and-hold itself.

It is true that the strategy achieves better drawdown (see Covid) and lower volatility, but this is an immediate consequence of being invested in cash for some periods. In 2022, the strategy would have been sitting for most of the time.

This must be kept in mind when we read or hear articles and posts such as “if we were not invested for the 20 worst days of the S&P 500 over the past 10 years…” and the like. These statistics are pointless, because there is no simple way to time the S&P 500 and avoid the worst days, and even if it were possible, it would be extremely hard. There is no public or scientific evidence that this can happen, as we have been learning for years from academic studies.

Moreover, the simple criteria like those mentioned above (but even more sophisticated regime-detection analysis, like Markov Switching models) cannot help in getting the outstanding outperformance that comes immediately after the falls, as one can clearly see in 2020. With different timeframes, settings and parameters, it is hard for a model to truly revert on time.

This does not mean that we can include any ETF in that period, like the volatility-based ones we are examining, to hedge our portfolio. Their use case is much different, as explained above, and any ETF we will try to include will not allow us to hedge against that risk if we just switch the entire portfolio composition over those times, leaving aside the transaction costs that we will have to pay for this.

A comparison: using volatility-based ETFs

What we will now test is how to include these volatility-based ETFs in our portfolio. These strategies, as already stated, are high risk, so we cannot consider them a buy-and-hold alternative.

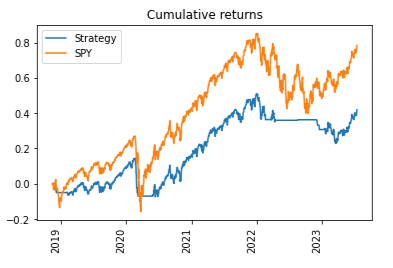

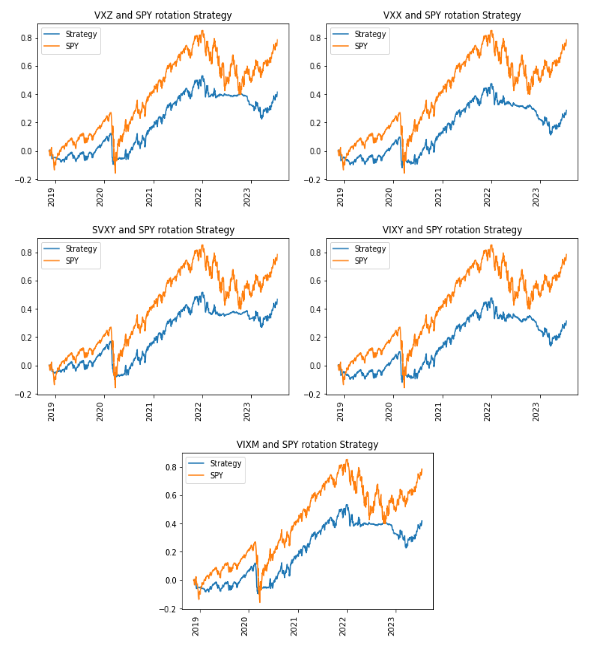

What would happen if we had to invest in any of those funds during the same period where the baseline strategy is in cash? These are what are called rotation strategies, as we invest in an ETF at a particular time depending on market conditions. In our case, we will not invest 100% in VIX strategies, but rather about 10% of our portfolio, as the risk is much higher.

We clearly see that there are some benefits, however the loss in volatility in 2022 makes us drop dramatically. We come back to the SPY too late, and our portfolio is hurt significantly, and the performance is even worse than the baseline strategy, on average.

Volatility-based strategies

Hedging is not easy with an asset that doesn’t truly diversify but rather hurts our portfolio. However, we can now have a look at another use case for volatility strategies: buy low and sell high.

In this case, we are going to long when the level is under the 10% percentile and sell when it reaches a 10% profit. There is no test on short positions.

With clear targets and proper execution, this asymmetrical strategy shows good results for some ETFs. It is more of an opportunistic strategy that should just play around the IV priced on the market, so it is not intended to provide profitable and sustainable returns, but rather trades that help in speculating over the levels of the VIX and VIX-like ETFs.

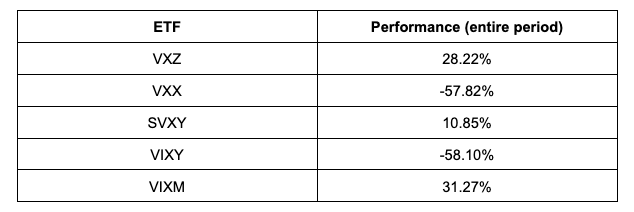

And this is the purpose of the ETFs themselves: to be held for a short time, and sold whenever possible. The performance, playing around the levels on different ETFs, is as per the below:

Not all ETFs revert the same way. SVXY (Short VIX short-term) in theory behaves in a very different way from other ETFs. The short-term strategies (VIXY and VXX) indeed exhibit a very negative performance, proving that it is not always profitable to trade volatility in this way.

However, with regards to mid-term (VXZ and VIXM), the performance is attractive, considering that the strategy is invested for just a few days over the period. But since this is an opportunity that only occasionally arises, it would make sense to profit from it only when we see it, and always keep a long-term investment in our portfolio.

If we invest in this strategy only, the returns will never be as good as buy-and-hold equities. It is very short term, and the final aim is to make opportunistic profits to add to our portfolio. It is intended as a short-term speculation strategy, and it makes much more sense to allocate an occasional amount of capital from the buy-and-hold to this ETF in order to integrate them together.

Final remarks

We can invest in volatility with short-term strategies using ETFs. The VIX and other ETFs do not help in diversifying or hedging, but rather offer quick opportunities to make some profits occasionally.

Even if using options, volatility is intended to be a short-term investment that can be profitable at times due to high pricing and particular market conditions. It cannot be a long-term strategy, nor can it be expected to outperform any buy-and-hold strategy, at least not in the simple terms we consider it.

However, if deployed on short-term, more meaningful strategies, it can add interesting returns and diversification to our portfolio.

Update on strategies

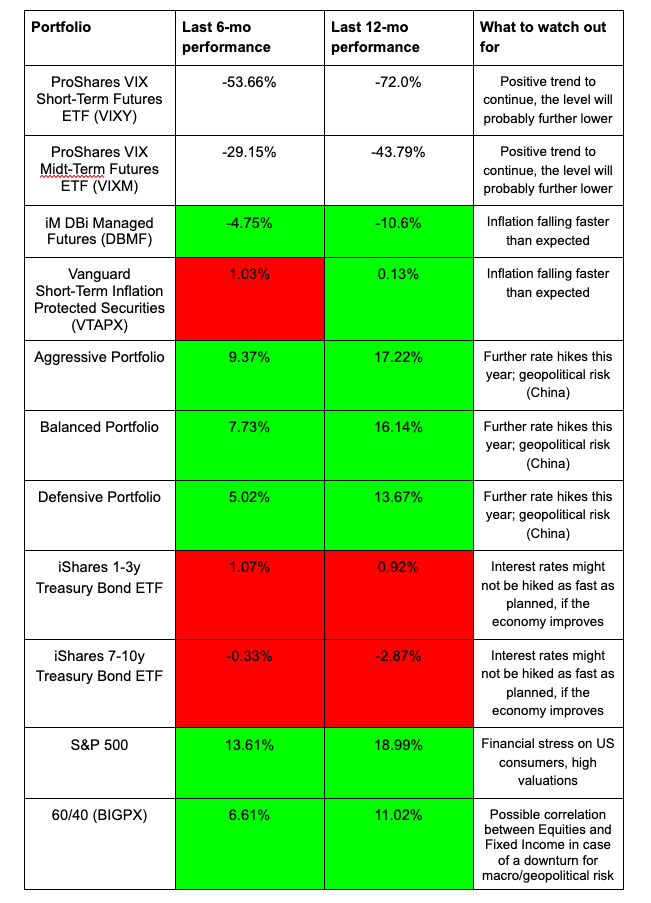

In addition to our previous funds, we are going to add three of our volatility-based strategies. The most interesting ones were SVXY, as it implements the Short VIX strategy, and then one each for short- and mid-term ETFs (VIXY and VIXM from ProShares, since they are the most correlated with the VIX).

Volatility is dramatically dropping from the ultra-high level it has been at since last year. Fixed income lost some ground, especially long-term securities. Equities continue their positive streak.

Updates as of July 13:

Trading strategy is based on the author's views and analysis as of the date of first publication. From time to time the author's views may change due to new information or evolving market conditions. Any major updates to the author's views will be published separately in the author's weekly commentary or a new deep dive.

This content is for educational purposes only and is NOT financial advice. Before acting on any information you must consult with your financial advisor.